The UK higher education sector is going through another period of seismic change. The removal of the student number control, a diminishing pool of 18 year olds due to a drop in the birth rate in the late 1990s, the legacy of increased tuition fees and of course Brexit are coming together to form a perfect storm.

Many universities who had thrived in a benign student number controlled environment, saw their number rise steadily. Until the Coalition Government in 2010, UK universities had benefited from a visa regime and an administration who actively supported them to increase international numbers. That environment feels like a distant memory, as the Indian market has slumped and Chinese numbers flatline.

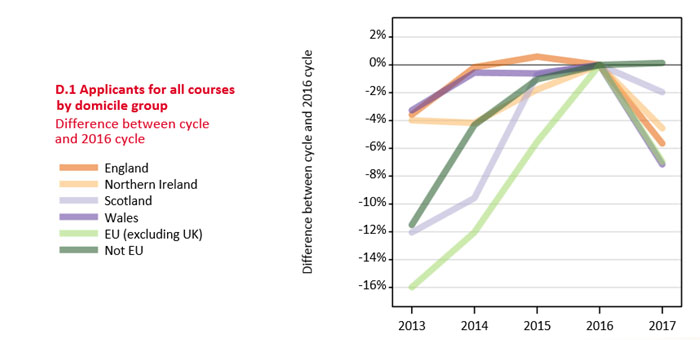

The UCAS figures published at the beginning of February 2017 allows us to start to get under the skin of the emerging challenge. A 5% drop in UK domiciled applicants, a 7% drop in EU applicants and a flat picture for International students set the backdrop for the new world. Although despite the drops this year, there are still more applicants in the system compared to 2013 (but fewer than 2014, 2015 or 2016).

(UCAS 2017 Cycle Applicants – January deadline)

Much has been made of the ‘squeezed middle’, the universities who have seen students they would traditionally expect to recruit move elsewhere in the system, and this is where the real shifts are starting to occur. According to UCAS data lower tariff institutions have seen a drop in applications of -10%, medium tariff institutions a fall of -5% and higher tariff have actually increased by +1%.

Through my work with the Hotcourses Group, across their sites they supported over 39 million students researching courses both domestically in the UK, but also for students across the globe looking at a number of international destinations. As volatile as the picture is in the United Kingdom, a similarly challenging picture is emerging in the United States. Whist Canada is being overwhelmed with demand.

Universities know that in the context of a changing international picture they need to use more sophisticated evidence to dictate which markets they will pursue, and sometimes when they need to pull back from an unrecoverable market.

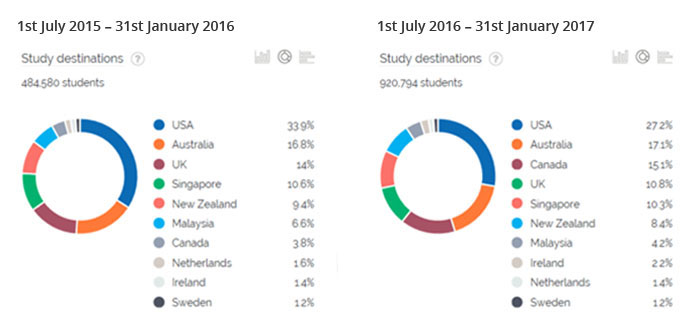

International student interest from India

Comparing the two time periods above, there is a significant drop in interest from Indian students looking at the USA (from 33.9% to 27.2%), there is also another alarming drop in UK interest too (from 14% to 10.8%). The rise of Canada is extraordinary from just 3.8% market share to 15.1%.

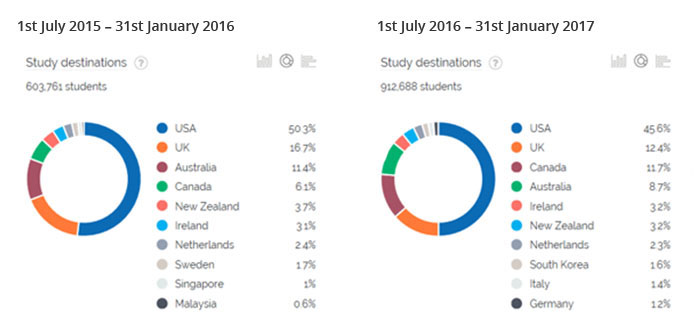

International student interest from Brazil

A similar picture emerges when looking from Brazil. A big drop for the US (50.3% to 45.6%) although it still remains the dominant preference, and a 4% fall for the UK (from 16.7% to 12.4%), whilst Canada increases from 6.1% to 11.7%.

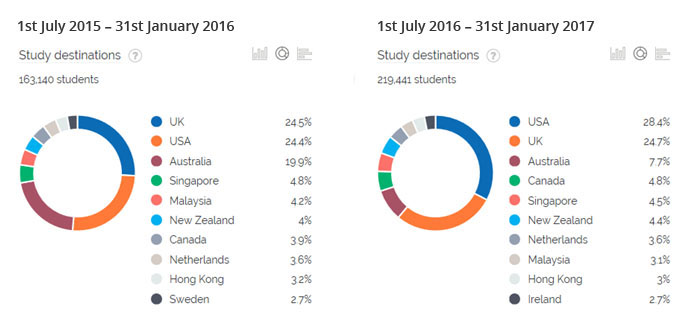

International student interest from Russia

There aren’t too many countries where the share of interest in both the US and the UK has increased, but perhaps for unsurprising reasons (at least for the US), Russian students are now turning their attentions across the Atlantic. I’m sure the President Putin will be pleased.

All of these issues and more will be discussed at the forthcoming Student Recruitment & Admissions 2017 national conference taking place on Thursday 18th May 2017 in Central London.

EDUCATION STUDIO READERS DISCOUNT!

Enter discount code EBDISCOUNT100 when registering your delegate place for a £100 discount off the delegate fee.

Aaron Porter

Conference Chair

@AaronPorter

The data in this blog was taken from the Hotcourses International Insights Tool which had over 39 million prospective students globally researching higher education courses in 2016. For more information or access to the tool, please contact insights@hotcoursesgroup.com